If you are looking for Medicare Supplement Plans in New Hampton, Look No Further!

Many companies that provide online quotes are taking your information and selling it to brokers like me. If you fill out their form, most likely you will get lots of phone calls and emails from different salespeople trying to sell you something.

Rather than put you through that, I want to work with you on a personal basis. I provide lots of free information on my website, including my free video classes that you can access 24/7. And when it’s time to give you a quote, I will provide it personally. I won’t sell your information.

There are different things to consider when getting a Medicare Supplement Plans in New Hampton Quote if you are a New Hampton resident, including the financial strength of the insurance company. But most importantly, I want you to understand what the customer service is like at the company you choose. To me, this is very high on the list of what to look for when purchasing a Medicare Supplement Plan in New Hampton.

My name is Kathe Kline, and I am contracted with many of the companies that offer Medicare Supplement Plans in New Hampton. I’m a broker, not an agent. This means I am not bound to any particular insurance company. I also offer the different types of Medicare-related plans, including Medicare Supplement Plans, Medicare Advantage Plans, and Drug Plans available in New Hampton.

Many of my clients in New Hampton have found me on YELP when they were about to turn 65. I’m proud of my high ratings on YELP and work diligently to provide the type of service that would make you want to give a high rating too.

Medicare insurance differs from the insurance you have carried personally or at work, so you will want to make sure you understand how your new plan works before signing on the dotted line.

There are two types of plans that deal with Medicare. The first is Medicare Advantage. This plan replaces Medicare Parts A and B. Many people incorrectly call “Medicare Advantage Plans” “Supplement Plans”. Medicare Advantage Plans works differently than Medicare Supplement Plans.

The thing about Medicare Supplement Plans (Medigap Plans) is that you don’t replace or cancel original Medicare when you buy one. You have all your Medicare rights and protections, along with the insurance company that fills the gaps.

Medicare Supplement Plans in New Hampton (or anywhere really) do not replace original Medicare the way Medicare Advantage Plans do. Supplement Plans only fill in coverage gaps, which is why they are sometimes called “Medigap” coverage plans or “Medigap Insurance”.

You can’t use both a Medicare Advantage plan and a Medicare Supplement Plan at the same time. Each plan has somewhat complicated rules. If you have a Medicare Advantage Plan, it takes precedence over the Supplement Plan, and you won’t be able to use the Supplement Plan. This is why you need to work with a broker who is knowledgeable in both types of plans.

As an example of the complexity, I had a client who was changing from a Medicare Advantage Plan to a Medicare Supplement Plan. The insurance company accepted her as of 3/1. But they didn’t notify her of this fact until 3/1. Because the only way to cancel her Medicare Advantage Plan was to purchase a drug plan (due to a Special Election Period or SEP that she had) her drug plan coverage wouldn’t go into effect until 4/1.

When she received notification that her Supplement Plan was in effect on 3/1, she didn’t believe me when I told her that she wouldn’t be able to use it until 4/1. We called Medicare to confirm this fact. Boy was she disappointed when they confirmed that her plan would actually not work until 4/1/ when the drug plan enrollment canceled her current Medicare Advantage Plan.

Why is it prudent to get Medicare Supplement Plans in New Hampton?

Medicare Supplement Plans in New Hampton are designed to help pay some of these co-pays, co-insurance amounts, and deductibles. How much of these will be covered is based upon which plan you purchase (not the insurance company you purchase it from)?

Medicare Supplement or Medigap or policies are standardized across all insurance companies and most geographic areas.

Since every Medicare Supplement Policy has to follow federal and state laws, they are identified formally as “Medicare Supplement Insurance”. So if you are searching for “Medicare Supplement Plans in New Hampton” and you find a policy with the Plan letter of F, it will offer the exact same coverage as the “Medicare Supplement Plans in Orange County”. This is because, by law, each plan with the same letter designation has to offer the exact same base coverage.

This works for every state except Massachusetts, Wisconsin, and Minnesota, because these states have different laws that govern their own Medicare Supplement Plans.

If an insurance company decides to sell Medicare Supplement Plans in New Hampton, they must offer a Plan A and a Plan C or Plan F. But they don’t have to offer any other plan. For example, the insurance company doesn’t have to offer High-Deductible Plan F (also known as F+ or HDF), Plan N, or Plan G. The insurance companies are allowed to make business decisions on which plans they want to offer but they must offer the same coverage as their competitors for each plan they offer.

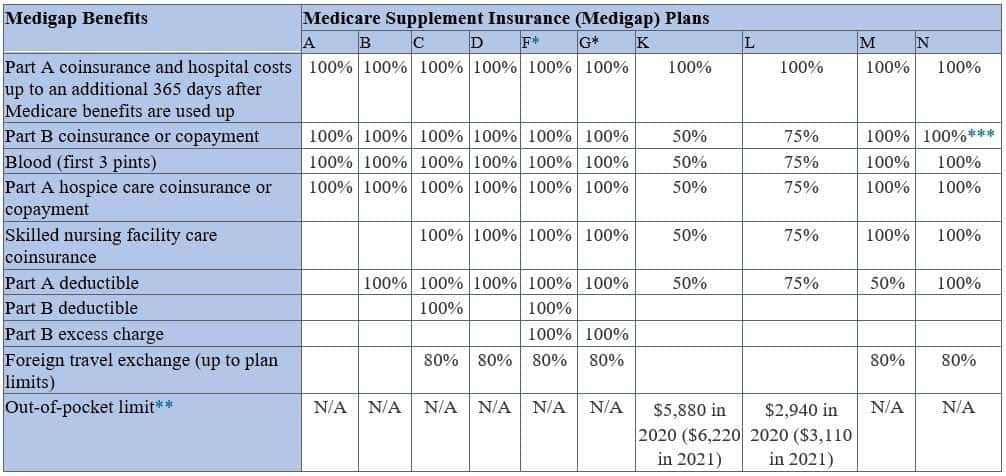

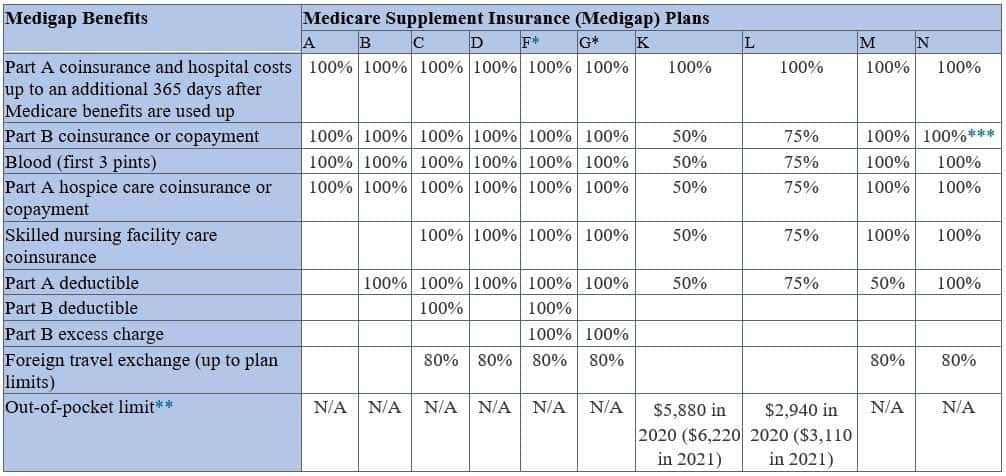

Let’s look at the Medicare Supplement Plans in New Hampton that were available in 2026 and what they offered:

* Plans F and G also offer a high-deductible plan in some states. With this option, you must pay for Medicare-covered costs (coinsurance, copayments, and deductibles) up to the deductible amount of $2,340 in 2020 ($2,370 in 2021) before your policy pays anything. (Plans C and F aren’t available to people who were newly eligible for Medicare on or after January 1, 2020.)

** For Plans K and L, after you meet your out-of-pocket yearly limit and your yearly Part B deductible, the Medigap plan pays 100% of covered services for the rest of the calendar year.

*** Plan N pays 100% of the Part B coinsurance, except for a copayment of up to $20 for some office visits and up to a $50 copayment for emergency room visits that don’t result in an inpatient admission.

As you can see, the plans were (and are) standardized. Each insurance company that offers Plan A, for example, will offer the exact same benefits.

However, some insurance companies may throw in bonuses that are not actually part of the standardized plan. A typical bonus might be to include a gym membership. Or it might include other benefits that are not actually part of the plan. Keep in mind that when additional benefits are offered, the insurance company is not required to keep them in your plan for the life of the plan. These additional benefits can be dropped or changed in the future.

What are the different types of Medigap plans along with costs?

Each insurance company offers different Medicare Supplement Plans in New Hampton to choose from. Each plan, signified by a letter, offers a different monthly premium depending on your zip code and the insurance company that you are considering.

As you probably suspect, the cost of Medicare Supplement Plans in New Hampton varies widely. The plan cost is not standardized like the benefits are. Generally, the plan letters with higher monthly premiums offer more benefits. We use a quoting tool in our office that shows us virtually all the Medicare Supplement Plans in New Hampton and what they cost.

This is how we are able to offer the right Medicare Supplement Plans to aid in matching the wants and needs of each of our New Hampton residents.

This is because some companies offer a “Welcome to Medicare” first-year discount. However, after the 12 months is up, the discount goes away and your premium goes up to $142 per month.

This might change in the future, but that’s what it was as of 03/2018.

Speaking of turning 65, it is important to note that you might not get a Supplement Plan if you wait. Insurance companies can disqualify you for certain medical conditions unless you are in a Guaranteed Issue (GI) situation. You’re just turning 65 is one such GI situation. If you don’t choose a Medicare Supplement Insurance Plan when you turn 65 you may lose your guaranteed issue status and have to qualify medically before qualifying for Medicare Supplement Insurance Plans in New Hampton.

Which plan do most people get?

In our office, we have found that the most popular Medicare Supplement Plans in New Hampton are Plan F plans. Plan F is the most comprehensive, and it is surprisingly affordable at age 65. Since it covers all your deductibles, co-pays, and co-insurance, most people who are attracted to Supplement Plans over Medicare Advantage Plans choose this one.

According to the American Association of Medicare Supplement Insurance, comparing Medicare Supplement Plans offered by different insurance companies operating in New Hampton can save you up to $50,000 over your lifetime.

Here’s how they explain it. They said that all Medicare Supplement Plans are standardized but not the costs. According to them, in 2017, the lowest cost Medicare Plan F for someone who was 65 living in Phoenix was $148 per month. If you had purchased the most expensive, it would have been $380 per month. The difference between the two is $2784.

If you were a 65-year-old male, your life expectancy was 84, or 19 more years.

They then took $2784 and multiplied it by 19 years and got $52,896.

I can tell you from past experience that oftentimes a person purchases a Supplement Plan from one company and then never compares it to other insurance companies again.

Over time, premiums can go up at different rates with different companies.

Some people don’t ask their Medicare Supplement Insurance agent or broker how many plans or companies they represent. In general, agents can only work with one company. Brokers usually offer different plans from multiple companies. I am a broker that offers most plans from most of the insurance companies offering insurance here in New Hampton.

If an insurance broker only offers two plans, then you might not be working with the least expensive plan in your area. Be sure to ask how many Medicare Supplement Plans in New Hampton your broker is contracted with. More plans may open more opportunities for you to save money in your particular situation.

Plan F was introduced as one of the most comprehensive plans. But you may save money by instead choosing Plan G.

Medicare Supplement Plan G is very similar to Plan F, except that it doesn’t cover the Part B deductible, which as of this writing is $183. Everything else is covered the same as Plan F. The only issue that I see here is that we don’t know what the Part B deductibles are going to be in the future.

Note: As of 2020 Plan F will no longer be offered to newly eligible Medicare beneficiaries without having to qualify medically. In other words, if you are new to Medicare after 2020 you won’t be able to get a Plan F. But if you are already on either Medicare Parts A and/or B, you may still be able to get it if you qualify medically.

Remember, insurance companies don’t have to sell you Medicare Supplement Insurance Plans in New Hampton if you have certain medical conditions unless you are in a Guaranteed Issue (GI) situation.

Plan N can also save you money:

Plan N looks good at first glance, due to low premiums along with the $20 co-pay after the Part B deductible, and the $50 copay for emergency care. However, use caution because it doesn’t cover “excess doctor charges.” California allows excess doctor charges, and these can add up if your healthcare provider doesn’t accept assignment (which means that they don’t charge this).

Medicare does not cover every possible condition. And if Medicare doesn’t cover it, Medicare Supplement Plans in New Hampton won’t cover it either (unless it’s one of those additional benefits we just discussed). That said, Medicare Supplement Plans can help defray the cost of deductibles and co-pays associated with Medicare Parts A and B.

Let’s look at some common items that original Medicare doesn’t cover:

This includes acupuncture or chiropractic services (except a limited number of visits to fix subluxation of the spine), massage therapy, transcendental meditation, acupuncture and other types of alternative or complementary care.

Elective cosmetic surgery is generally not covered. But if certain surgeries are required to fix a “malformation” it might be covered.

And if you had a mastectomy due to breast cancer, Medicare Part B (Medical Insurance) covers external breast prostheses (including a post-surgical bra) after a mastectomy. Medicare Part A (Hospital Insurance) covers surgically implanted breast prostheses after a mastectomy if the surgery takes place in an inpatient setting.

Part B covers breast reconstruction surgery if it takes place in an outpatient setting.

Medicare does not cover nursing home care, assisted living communities, or adult daycare. Medicare also does not cover the cost of hiring someone to help you with bathing, toileting, and dressing, or housekeeping, shopping, meal preparation, etc. And that’s right if Medicare doesn’t cover it, neither will Medicare Supplement Plans offered in New Hampton.

However, nursing home care or personal care might be covered under Medi-Cal if you qualify.

Remember, if Medicare doesn’t cover it, Medicare Supplement Plans offered in New Hampton won’t cover it either.

Medicare does not cover cleanings, fillings, or dentures. Part A of Medicare might pay for certain services you may undergo while being hospitalized for an emergency.

If Medicare won’t pay for your dental care, then Medicare Supplement Plans in New Hampton won’t cover these items either.

Note: You can purchase a dental plan as an optional benefit through many providers, and there are stand-alone plans you can purchase as well.

Medicare doesn’t cover routine vision care such as eye exams, refraction, contact lenses or eyeglasses — except when following cataract surgery. However, if you have diabetes, you can get a regular eye exam for diabetic retinopathy.

And you are correct, Medicare Supplement Plans offered in New Hampton, Iowa won’t cover these either unless you purchase an optional “buy up”, which some plans offer.

Medicare doesn’t pay for routine hearing exams or hearing aids. However, Medicare might cover hearing implants to treat a severe hearing loss under Medicare Part B if a doctor or other health care provider orders them. This type of implant might be covered under Prosthetics.

Medicare doesn’t cover routine foot care, which includes removing corns or calluses. It also doesn’t cover orthotics or orthopedic shoes.

If you have diabetes and have diabetic nerve damage, it will cover foot exams and treatments. Medicare will also cover foot injuries and diseases such as heel spurs, hammertoes, and bunion deformities. It will also cover plantar warts and some kinds of toenail fungus.

Once again, if original Medicare won’t pay, the Medicare Supplement Plans in New Hampton won’t cover it either.

Some people might need transportation from a care facility to the hospital for surgery. Or they might need transportation from a Skilled Nursing Facility back home. Many times this is provided in an ambulance. Medicare does not cover non-emergency Ambulance Services.

In most cases, Medicare will not cover health care received outside of the USA. However, if “you live in the U.S. and the foreign hospital is closer to your home than the nearest U.S. hospital that can treat your medical condition, you can be covered regardless of whether it’s an emergency.”

Some Medicare Supplement Plans have limited coverage for medical emergencies while traveling.

We usually advise our clients to purchase travel insurance due to the limitations of these plans.

Medicare Part A covers both hospitalization and in-patient care. If you are staying overnight as an inpatient, Part A is what covers that. Part A of Medicare includes hospitalization, skilled nursing facilities, and home health care.

Part A, Days 1-60 for Hospitalization

When someone is hospitalized, there is a deductible for the first 60 days. In 2018, the deductible for Part A of Medicare is $1340. But… the deductible is not per year, it’s actually per occurrence.

So you can pay more than one deductible in the same calendar year.

Let’s look at some examples:

In this example, you live in New Hampton, and in January, you fall down the stairs and break your hip. You are admitted to the hospital and you stay for 10 days as an inpatient. After the 10 days, you are moved to the a Skilled Nursing Facility and you stay there for another 10 days. Then you go home.

But then in September, you have a stroke. This time you are admitted to the Hospital again and stay for another 4 days. You recover and don’t need Skilled Nursing this time so you just go home.

That hosptial New Hampton hospital stay for the stroke would be a second occurrence, and you would pay the Part A $1340 deductible again.

So just keep in mind that your Part A deductible is per occurrence, and you can wind up paying a Part A deductible more than once during the year.

Don’t worry though. You can get Medicare Supplement Plans in New Hampton that can help you defray the cost of these deductibles.

After you’ve been in the hospital over sixty days, your payment will change. From days 61 through day 90, you’ll have a per day co-pay, and in 2018 that copay is $335 per day or up to $10,050.

*But the maximum isn’t per year. It’s per occurrence. So if you had two events in two different benefit periods, your maximum could be $10,050 x 2 or $20,100.

If you are in the hospital over 90 days in one benefit period, your Lifetime Reserve Days (LRD) will apply. You’ll use them for days 91-150.

Your year copays, while you are using LRD, is $670 per day, up to $40,200 in 2018. The bad news is that you can only use these days once. There is no benefit period “reset” on these LRDs.

What that means is that once you have been in the hospital for over 150 days and have used up your lifetime reserve days, you are responsible to pay all costs.

This means that without a Medicare Supplement Insurance Plan or a Medicare Advantage Plan you could potentially have unlimited financial liability.

With my financial background, an unlimited liability is unimaginable to me.

It’s prudent to limit a potentially unlimited liability, and that’s why my clients choose either Medicare Advantage Plans offered in New Hampton or Medicare Supplement Insurance Plans in New Hampton.

Not all plans are right for all people. That’s why there is a choice.

Let’s now talk about Skilled Nursing Facilities (SNF), which I mentioned in the example above.

Earlier we discussed someone falling and breaking her hip? She was admitted to a hospital for a few days. She was released from the hospital but still needed additional care, so she was admitted to an SNF.

Medicare does not cover SNF care unless there was a 3-day inpatient stay immediately prior to the SNF stay. Sometimes you can be admitted to the hospital and actually stay overnight, but you’re an outpatient according to the hospital.

At this writing, in 2018, you must be given a notice called the MOON notice that explains whether you are an inpatient or an outpatient.

But I still recommend that you ask, “Am I an inpatient or am I an outpatient?”

This is because if you are not in the hospital as an inpatient for a minimum of three days, Medicare will not pay for any of your SNF.

The good news is that if you ARE eligible, Medicare will pay 100% of your SNF for the first 20 days, and then for days 21 through 100, you’re responsible for a co-pay.

In 2018, the copay is $167.50 per day. After 100 days per benefit period, you’ll pay all costs.

Then, after you are in the SNF for 100 days, Medicare will not pay anything. That means that you’ll be responsible for all costs.

Note: Remember, it’s per benefit period, not per year. Also note that if Medicare does not pay, Medicare Supplement Plans in New Hampton won’t pay either.

Let’s look at Part B and what you’re responsible to pay under this portion of Medicare.

On top of the monthly premium for Part B, there is also an annual deductible. In 2026 the Part B deductible was 0 for the year.

After you pay the deductible, Medicare covers 80% of the approved amount for your medical expenses and you pay 20% of the approved amount (plus 100% of any applicable excess doctor charges).

Let’s for example’s sake, say you go to the doctor three times in year. As I mentioned earlier, in year the Part B deductible was 0. Just for simplicity’s sake, we’ll say that the first time the doctor charges exactly 0. Because of the deductible, if you didn’t have any Medicare Supplement Plans for New Hampton residents, you would pay the entire 0.

The second time you go to the doctor, she charges you $183 again. But this time Medicare picks up 80% and your costs would be ($183 x.20) or $36.30.

For your third visit, the doctor charges you $255. This time your co-insurance amount is $255 x.20 or $51.

This would continue through the calendar year and then would start over the following year. The following year the deductible might change so you would need to use those new deductible amounts.

Let’s now discuss the “excess doctor charge” that I mentioned earlier.

Most (but not all) doctors in New Hampton accept original Medicare. This isn’t true with Medicare Advantage, so be sure to ask the right questions. You can also use Medicare’s Physician Compare tool to find out.

To access the Physician compare tool just go to medicare.gov/physiciancompare/.

This tool will also tell you if your doctor accepts Medicare Assignment, which will let you know if there will be an “excess doctor charge”.

The reason you might be responsible for this fee is that doctors can accept original Medicare without accepting “Medicare Assignment”. If a doctor does not Medicare assignment, that doctor can charge up to 15% more than the approved amount, and you would be responsible for 35% of the Medicare-Approved amount. This includes the original 20% coinsurance amount that we discussed earlier, plus the 15% “excess doctor fee”.

It might not be an issue for a $200 office visit, but it can be a huge problem in the case of a $300,000 surgery. It can be a potentially large liability if you have only original Medicare, without the protection of Medicare Supplement Plans, New Hampton.

Medicare Part B pays 100% for clinical laboratory services and also covers 100% of the approved amount for home healthcare. For outpatient services, the payment is based on the procedure that you’re having.

When looking at the cost of blood, consider that you have to pay for the first three pints of blood, and then after that, Medicare will pay 80% of the approved amount and you’ll pay 20%.

I usually tell my clients to estimate about $500 per pint, so if you need blood it can be expensive.

The good news is that there are Medicare Supplement Plans in New Hampton that will cover these costs.

The easiest time to buy Medicare Supplement Plans in New Hampton is during your Medicare Supplement Open Enrollment Period. This is because during this time period the insurance company can’t ask you any medical questions, and you are guaranteed to be issued the policy.

This special period lasts for six months. It starts on the first day of the first month in which you are:

In some states, these plans might be available to those under age 65. For those applying for a Medicare Supplement policy prior to age 65, your Medicare Supplement Open Enrollment Period begins on the first day you’re enrolled in Medicare Part B.

Some but not all companies will accept applications for Medicare Supplement Plans in New Hampton before your Medicare Supplement Open Enrollment Period officially begins. If you currently have coverage that ends when you turn age 65, completing your application with an agent before open enrollment might allow you to have continuous coverage without any breaks.

There are many Medicare Supplement Plans in New Hampton, IA. This article focused mainly on Medicare Supplement Plans. There are also many Medicare Advantage Plans offered here. Medicare Advantage Plans have their own pros and cons. My team and I are ready to assist you with your needs.

New Hampton is a city in, and the county seat of, Chickasaw County, Iowa, United States. The population was 3,494 at the time of the 2020 census.

Current weather in New Hampton, IA

Things to do in New Hampton, IA

50659